The downside is that not only are you adding years onto your mortgage, but you’re likely to be on the hook for more interest over the life of the loan. Lowering your monthly mortgage payment with a longer-term loan: When you extend your loan’s repayment term, your monthly payment will decrease. There are a lot of reasons to refinance your existing mortgage, including: Knowing when to refinance is an important decision. What Are the Most Common Reasons to Refinance?

In this scenario you would break even in 24 months - or two years. To figure out how many months it will be until you break even, you divide the refinance cost, $6,000, by your monthly savings, $250. Let’s say it will cost $6,000 to refinance, but your lower mortgage payment will save you $250 a month. So before you pay thousands of dollars to refinance, you should do the math first. The break-even point of a mortgage refinance is when the money you save is equal to what you paid in upfront closing costs.

#Refinance mortgage calculator how to

How to Calculate the Break-Even Point of a Refinance Refinancing is a big decision - and a long-term commitment. So you’re paying for it in one way or another. Although some lenders may give you credits to cover closing costs in exchange for a higher interest rate. You’re still responsible for the fees, you’re just not paying them upfront and are paying them over the life of the loan instead. This is often referred to as a no-closing-cost refinance, although that’s a bit of a misnomer. The specific fees you pay differ depending on a handful of factors, like where your home is located or the type of refinance you’re getting, but can include:ĭepending on how much equity you have in your home, you may be able to add some, or all, of your refinance closing costs onto your new loan. What you pay will vary, so it’s important to shop around for the best mortgage lender for your refinance loan. Refinance closing costs are usually 2% to 5% of the new loan balance, so you’re potentially looking at thousands of dollars in fees. When you refinance your mortgage, you won’t have to make a large down payment - but you’ll still have to pay closing costs. How Much Does it Cost to Refinance a Mortgage?

With a cash-out refinance, you’re getting a new loan that’s worth more than you owe and pulling out equity built up in the home. A rate-and-term refinance alters the interest rate or term - sometimes both - of an existing mortgage, and equity isn’t taken from the home. You have two basic options when refinancing: a rate-and-term refinance or a cash-out refinance. You can also refinance into a shorter-term loan, which can help you save on interest and own your home outright sooner. Refinancing a mortgage commonly lowers your interest rate and monthly payment, giving you more liquid cash month to month.

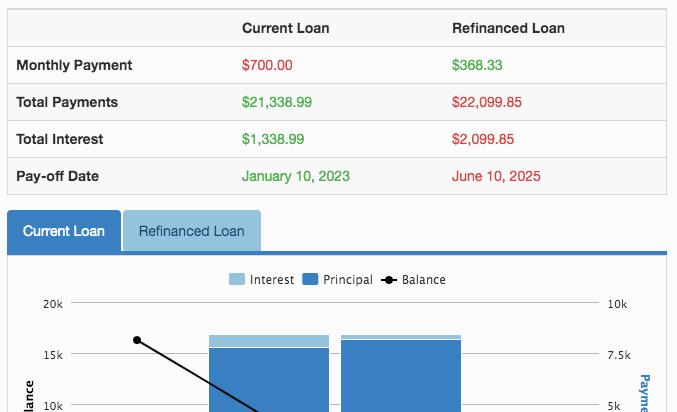

When you refinance, the original loan is paid off with money borrowed from the new loan. Most people refinance when they have equity in their home - the difference between the worth of the home and the amount owed to the lender. Refinancing is similar to any other loan in that you must apply, and the process involves a deep dive into your credit, income, employment history, and finances. Refinancing a mortgage is essentially replacing your current home loan with a new loan. With this calculator, you’ll also be able to instantly see if the new mortgage will save or cost you money in the long run. On the other hand, if you increase your monthly payments with a shorter-term loan, you would pay off your mortgage sooner and save on interest over the life of the loan. If you greatly increase your loan term you could end up paying more interest in the long term because you’re borrowing the money for a longer period of time. Our calculator will automatically display your new monthly payment and how much you’re saving or overpaying each month. Then, choose a refinance term and a new interest rate. To use the mortgage refinance calculator, plug in your current monthly payment, loan balance, property value, and the number of years remaining on your existing mortgage. This mortgage refinance calculator can help you compare what a refinanced mortgage payment might look like with your current mortgage payment - as well as calculate how much you’ll save or lose by refinancing your home. With mortgage refinance rates near historic lows, many homeowners are looking at potential benefits to refinancing.

0 kommentar(er)

0 kommentar(er)